“She works hard for the money, So hard for it honey…” sang Donna Summer in her hit song from 1983.

The last thing any of us want to do is LOSE the money we have worked so hard for by making a bad investment. After working and sacrificing to earn enough extra money so that we have something to invest, trying to decide where to invest that precious resource is nerve wracking. We all know some investments are riskier than others, so where can we put ours so we can relax and watch it grow, not go down the drain! Here are a few things to consider:

Cash Loses Value

Keeping wealth in the form of cash, while certainly safe and liquid, is not an investment. If there is any inflation or economic growth, your cash is losing value stashed under your mattress or even sitting in the bank. But if you’re going to put your money to work so it will grow, why choose real estate over other options?

Real Estate is Real

Real estate investments are real things. They exist, they serve a purpose and under every real estate investment is the land. Some real estate investments are just the land, and, as someone said, “They ain’t making any more of it!” Therein lies one of the components of value: scarcity.

Have you ever seen a Derivative? What can you do with a Stock Certificate? What do Bonds actually look like?

More importantly, what drives the value of typical Wall Street investment vehicles versus what drives the value of real estate? Let’s take a look.

The stock market is influenced by many factors, some of which are tied to the performance of the companies issuing the stock, while others are not. If a publicly traded company performs better than expected, the value of its stock will typically go up. However, it will also fluctuate on expectations of the industry that company is part of regardless of how well the individual company is doing. And on a broader scale, all stocks move up and down based on the whims of investors and their interpretation of the national or world economy as a whole, as well as current events. The value of a company’s stock can go down dramatically even if it is well managed, has strong sales growth and is effectively controlling its costs, all due to outside factors not controlled by that company.

However, Real Estate values are established on more basic fundamentals and do not fluctuate wildly. In fact, the value of real estate moves quite slowly and – as history shows us – primarily goes up.

Values are driven by the laws of supply and demand. If a community has a stable or growing economy and is experiencing job growth, demand for housing increases. While new houses and apartments are built every year, in many areas this new supply does not keep up with the growing demand, thereby increasing the value of all residential properties, including apartments.

Conversely, if a community is suffering from a shrinking number of jobs – such as when a major employer shutters its plant or moves out of town – a drop in housing demand will typically follow. Consequently, rental income falls, as does the corresponding value of those rental properties. That’s why it is so important to choose the community you invest in carefully and why we do so much research!

Real Estate is Stable

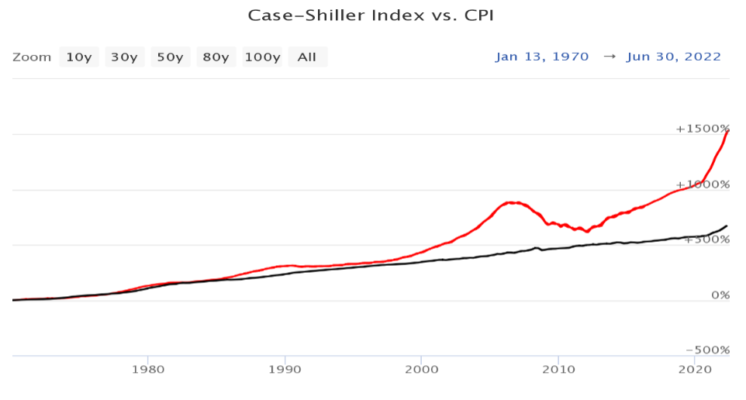

Over the last 100 years, real estate prices have moderately outpaced inflation and, more recently, values have increased dramatically faster:

Some would say this is evidence of another housing bubble, but the macroeconomic fundamentals prove otherwise. With our growing population and the catch-up of delayed household formation caused in part by the 2008 recession, demand for housing remains high in most communities.

Yet all real estate markets are local, and any opportunities must first be analyzed based upon the community where they are located. Only if those local economic conditions demonstrate a solid foundation and continued economic growth should we move on to analyzing the opportunity provided by an individual property.

Why are banks willing to lend 70% to 80% of the value of commercial real estate? Because they know it’s a safe investment. Try asking your bank for a loan to go buy stocks and bonds. How would they respond? Sure, you can borrow on “margin,” but what happens if the stocks you borrowed against go down in value? The lender asks you to pay your loan back then and there.

Short Term Leases

With apartments, most leases are 6 to 12 months long. As leases renew, the rental rates are adjusted to the current market, allowing the total income from rents to increase quickly. Other commercial property types, such as retail, office, and industrial space, typically have longer lease terms of five to ten years, with the rent amounts predetermined for the whole lease period.

Bank Requirements Create Safety

Unlike with residential loans, commercial property lenders are not as concerned about a borrower’s credit score and income. Instead they analyze the income and expenses of the property. For any lender to agree to fund a loan on an apartment building, that property must be able to pay for itself. Lenders then calculate what they call the Debt Service Coverage Ratio. Simply put, the (rent) income left over after paying the bills (taxes, insurance, maintenance, etc.) must be enough to cover the loan payments, PLUS have extra money left over. Typically, a lender requires the Net Operating Income to exceed the loan payment by 20% to 25%, ensuring a cushion remains.

So, as investors we can have confidence that the lender, through stringent analysis, has determined that the property can pay all its expenses and that after making the loan payments there will still be cash to spare left over.

Stress Tests

When we analyze the potential purchase of an apartment community, we put the property through a variety of stress tests to determine how various situations affect the financial well-being of the project. We look at how unlikely events – such as a prolonged duration of high vacancies or increased expenses – effect the cash flow. What is the break-even occupancy rate? What if rental rates drop or expenses rise higher than we projected? By visualizing challenges such as these beforehand, we can identify potential weak spots in a project and either adjust our approach or pass on the property entirely, thereby minimizing the risk any particular property may entail.

Limited Partners have Limited Liability

When you own a property yourself, you of course have all the responsibilities of managing that property, and you also have all the direct liability should anything go wrong. Sure, insurance will protect most risks but, even if it does, the time required to deal with the issues can be significant. If managing your property is not your primary occupation, can you afford that time? And there is always the possibility that the bank will go after your other assets if the property doesn’t perform the way it should. putting your other assets at risk

However, when you invest in an apartment building as a limited partner, your ONLY risk is the amount you invest. You are shielded from any other liability, such as tenant lawsuits, vendor disputes and bank requirements. The general partners take on all that risk and liability, as they are the ones managing the asset.

Housing Shortages

In the past few years we have witnessed the effects of the current housing shortage. A prolonged period of artificially low interest rates spurred demand and have driven home prices dramatically upwards. Consequently, many buyers trying to purchase a home for their family have found themselves in a bidding war.

Increased building costs have contributed to this price inflation, exacerbated by the recent supply chain shortages and record inflation rates. And nearly a third of the cost of every new home and apartment building goes solely to meet government regulatory requirements.

New household formation was delayed by the 2008 recession, though prior to the COVID pandemic we saw that trend begin to reverse. Nonetheless, it is estimated by George Ratiu, the Senior Economist at Realtor.com, that currently the country has a shortage of over five million housing units.

With the high cost of single-family homes coupled with the recent increase in interest rates, more people who desire to own a home are prevented from doing so and are forced to continue renting. Vacancy rates of rental homes in many areas are at record lows, driving the demand for more multifamily rental units. It is estimated by the National Multifamily Housing Council that the country needs an additional 4.35 million apartment units to be built by 2035. Currently we have built on average only about half a million units per year over the last five years. Bad news for renters, but good news for you!

Recession

When the economy is struggling, many investments struggle along with it. Investor sentiment and fear of a slowing economy can itself reduce the value of traditional Wall Street investments. This is where apartment investments really shine. When fewer people are willing or able to purchase a home, they remain renters out of necessity. And rent is usually the first bill that people pay, in good times and bad. Even during the eviction moratoriums that were in place during the COVID pandemic, most folks managed to make their rent payments. Those who didn’t simply moved to a less expensive place to live, as they knew their rent would not be abated or forgiven.

When economic times are difficult, Class C and B apartment buildings are typically unaffected and rent collections remain stable, as does the value of the investment.

Safety First

In the early 1800’s, E.I. du Pont de Nemours founded a company to manufacture gun powder. Unusual for that time, du Pont cared about the welfare of his workers and his community – so much so that he built his family home in the blast zone right next to the factory as a testament to its safety.

At Specialty Investment Group, we put our own hard-earned money alongside that of every investor in each apartment community that we purchase and manage. Our priority is to provide a safe investment for everyone who chooses to join us. With excruciating attention to detail, we manage each investment to, first, not lose and then to win. We partner with high-performing property managers and vendors. We control costs and effectively invest our capital to improve each property. From the onset, we chart a course to increased revenue and a safe and reliable return on your invested dollars.

Join us!

Why not join the Specialty Investment Club today? You’ll learn more about investing in apartment buildings in general, and we will notify you about upcoming opportunities to invest. This is your chance to put to use that money you’ve worked so hard for. Let it work for YOU now!